how are rsus taxed in california

RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future. How are RSUs Taxed.

How Equity Holding Employees Can Prepare For An Ipo Carta

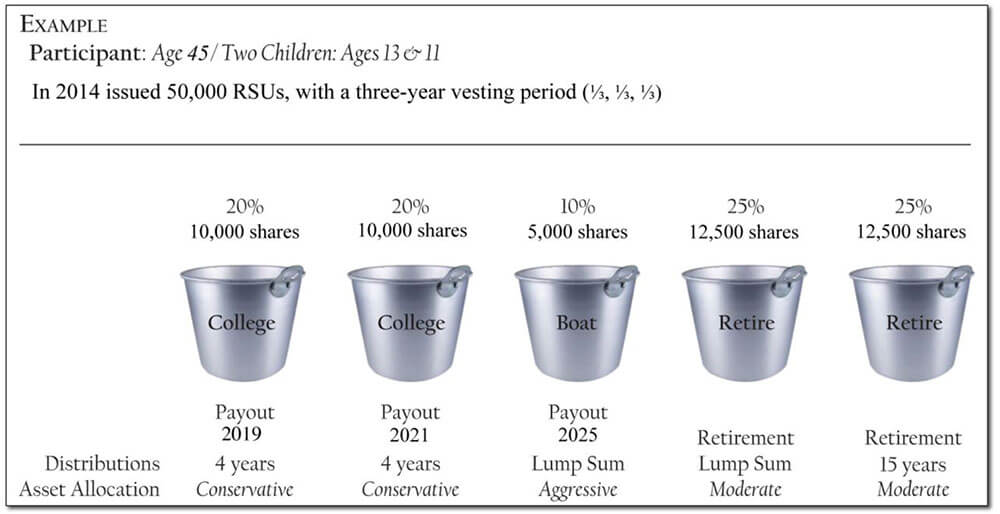

Lets consider this example.

. If you dont sell for a year plus a day it is only additional gains which are taxed as long term gains - you still have a tax liability in the year of the vesting for the initial value regardless of whether you sold. Your taxable income is based on the value of the shares at vesting. However its still important to understand and manage it appropriately.

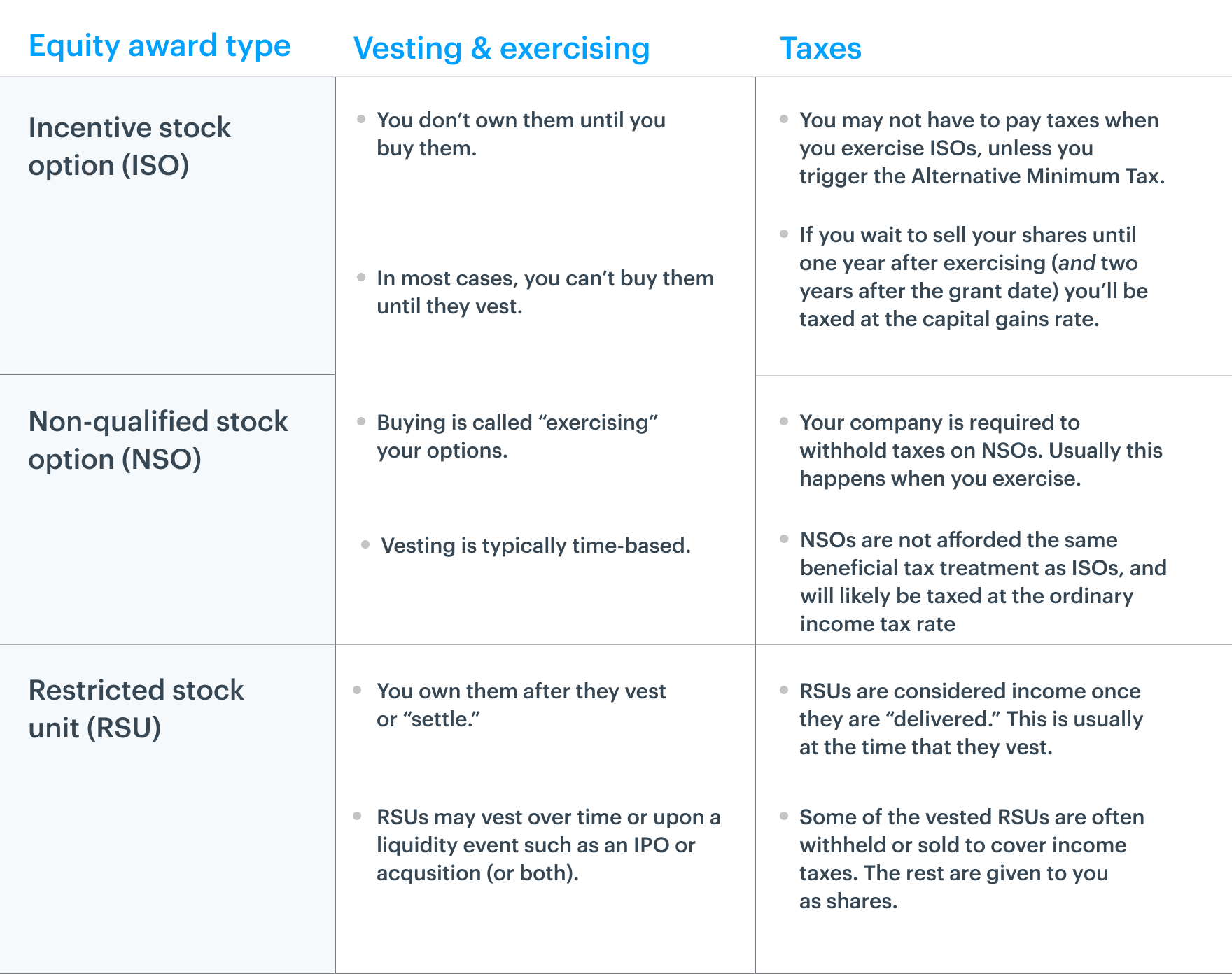

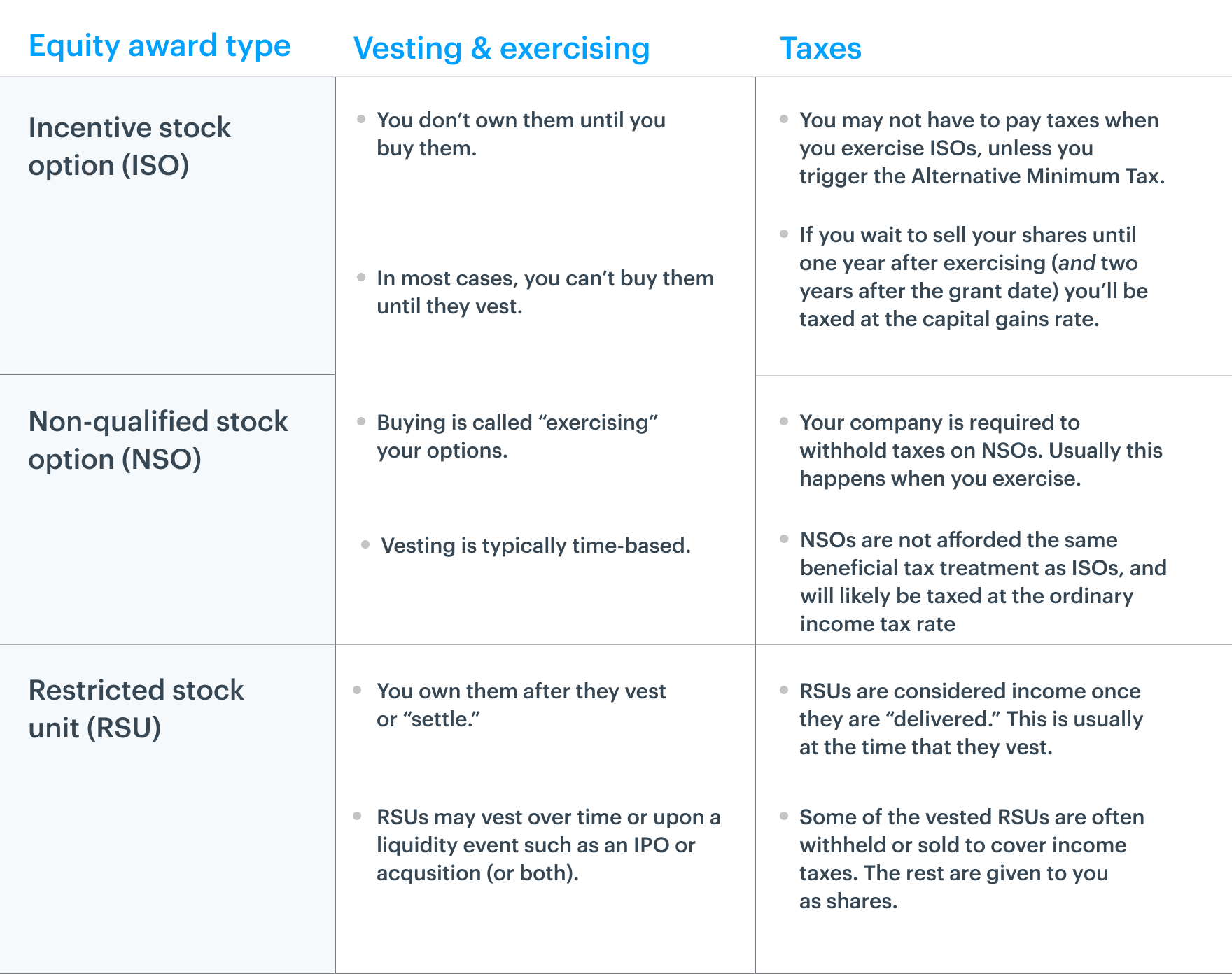

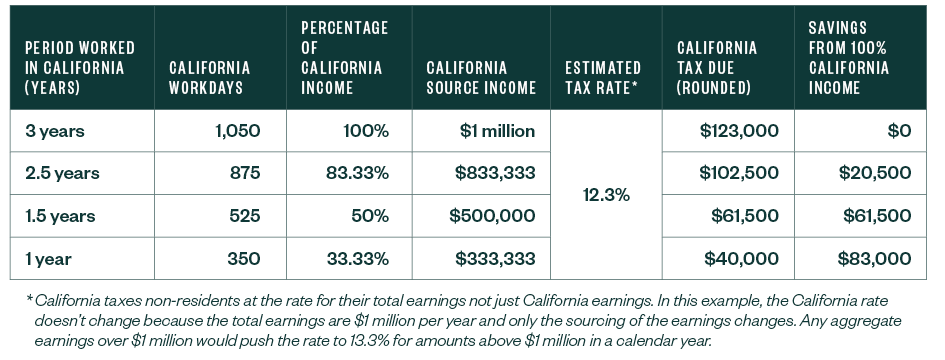

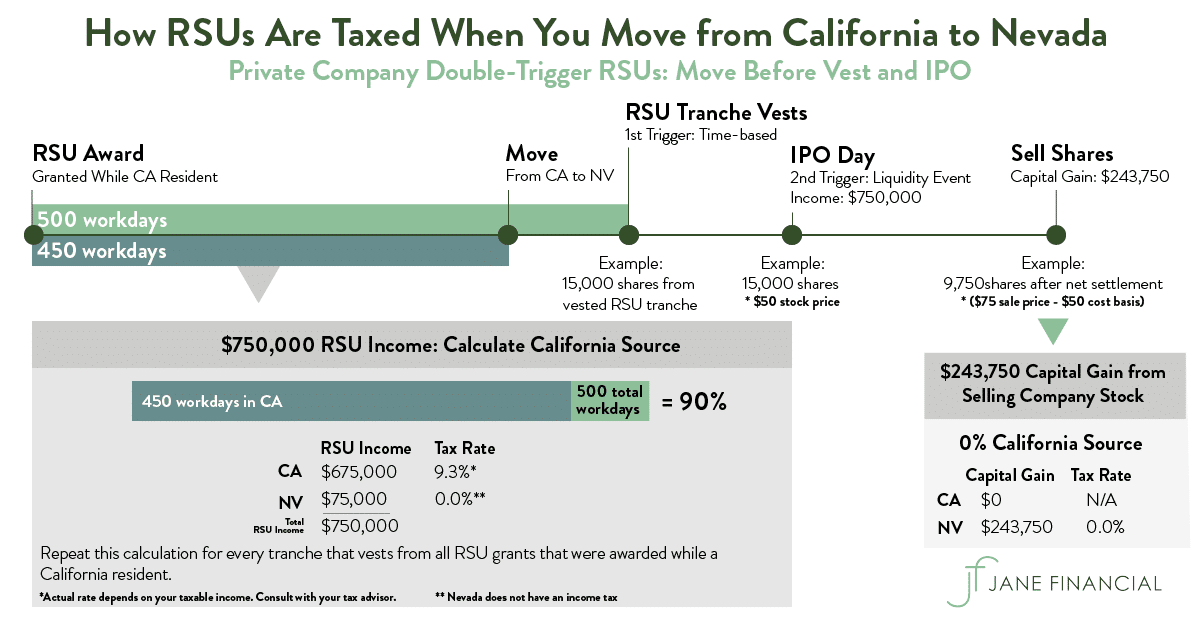

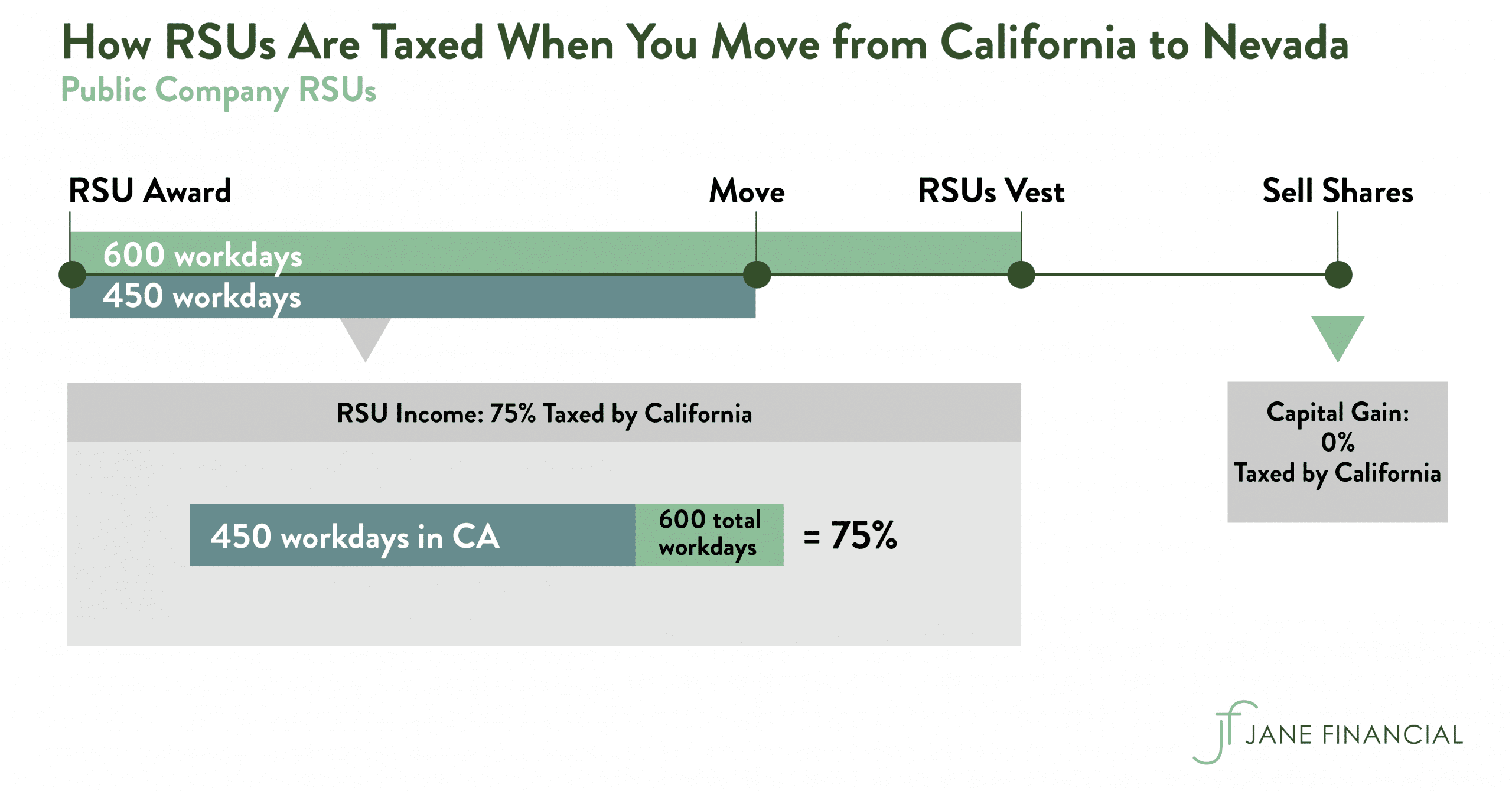

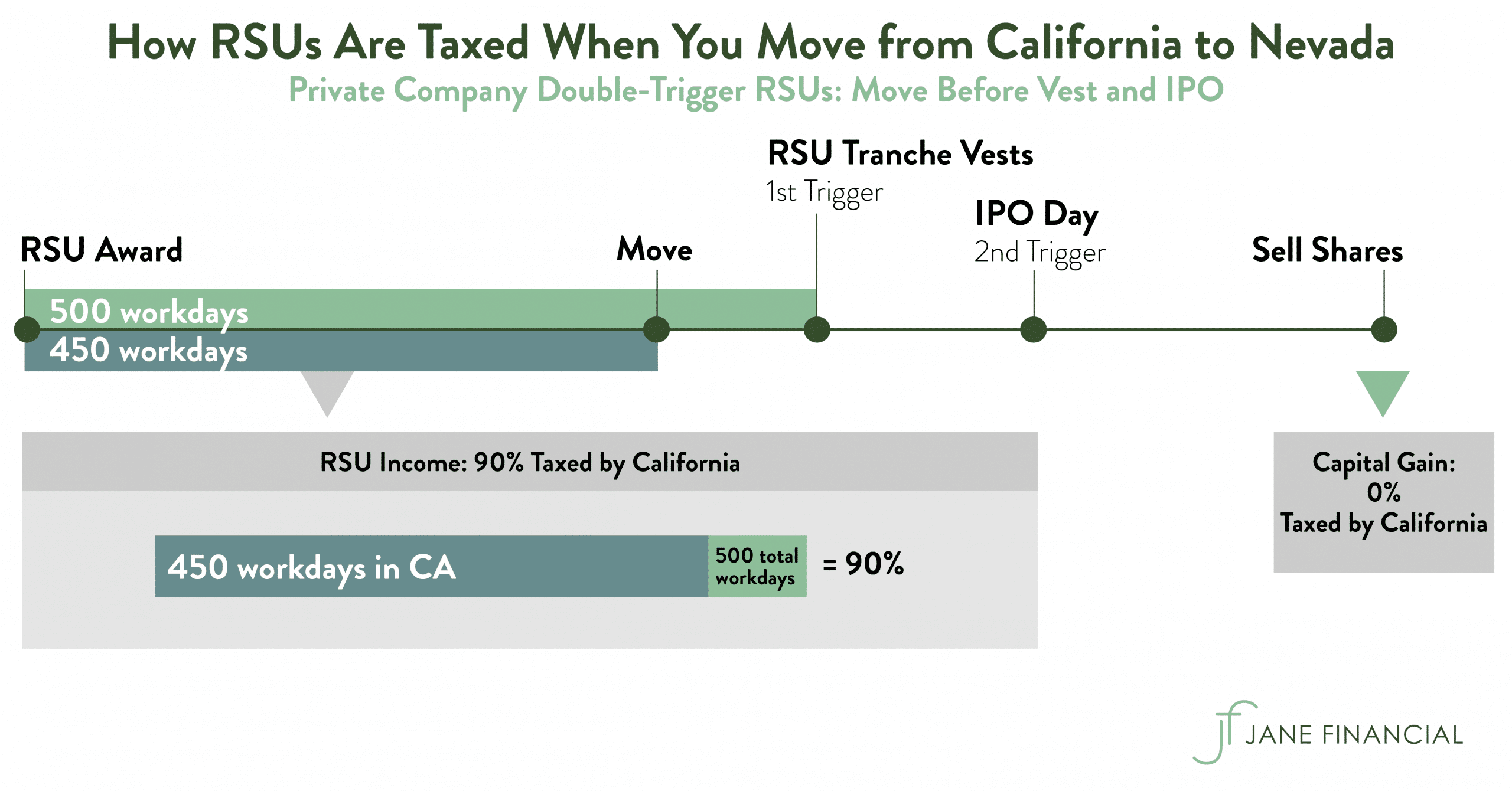

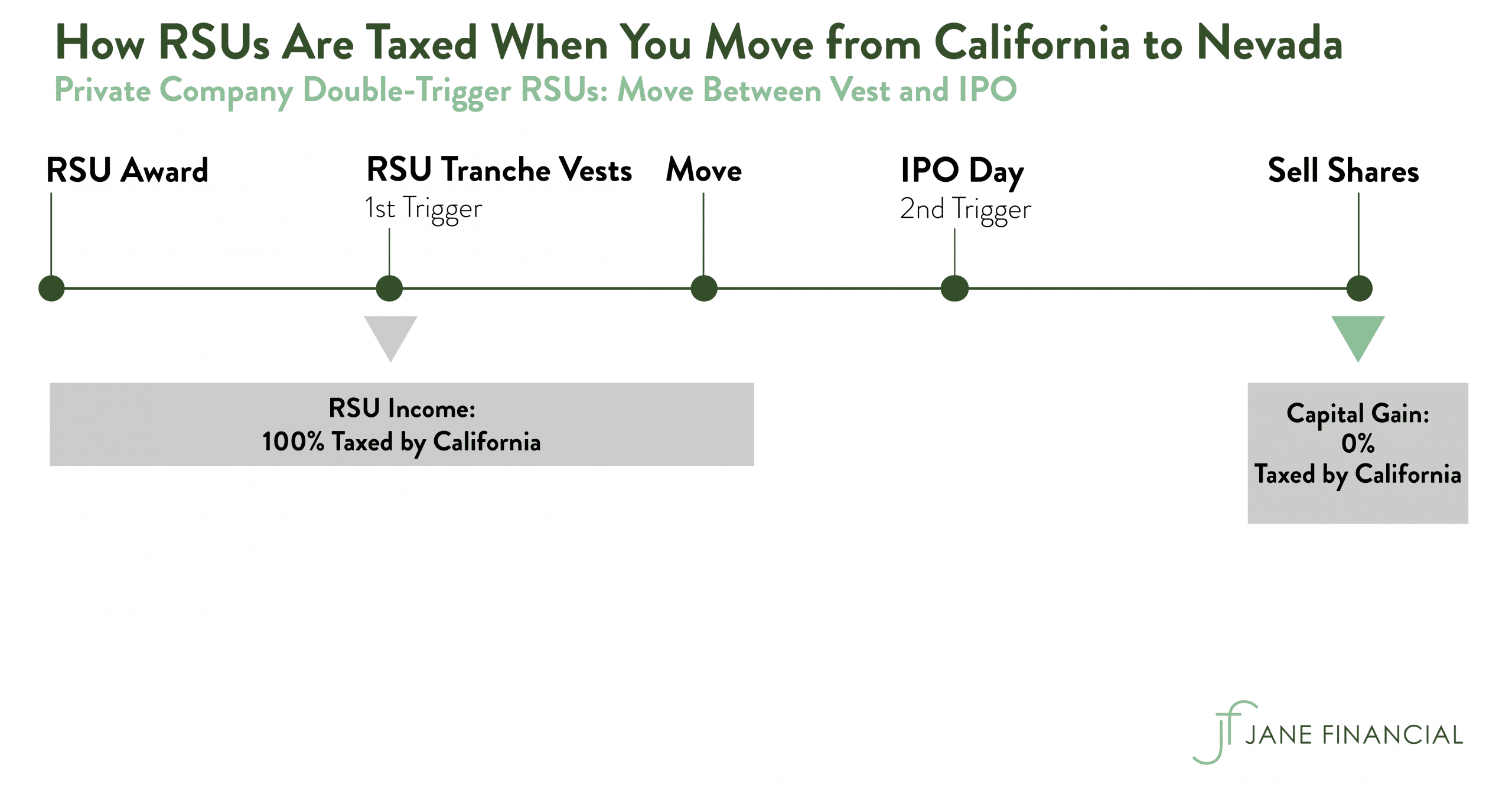

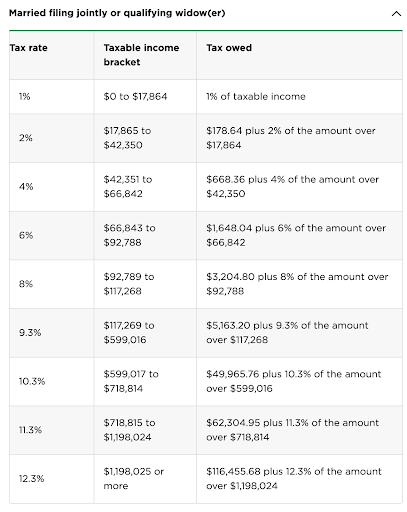

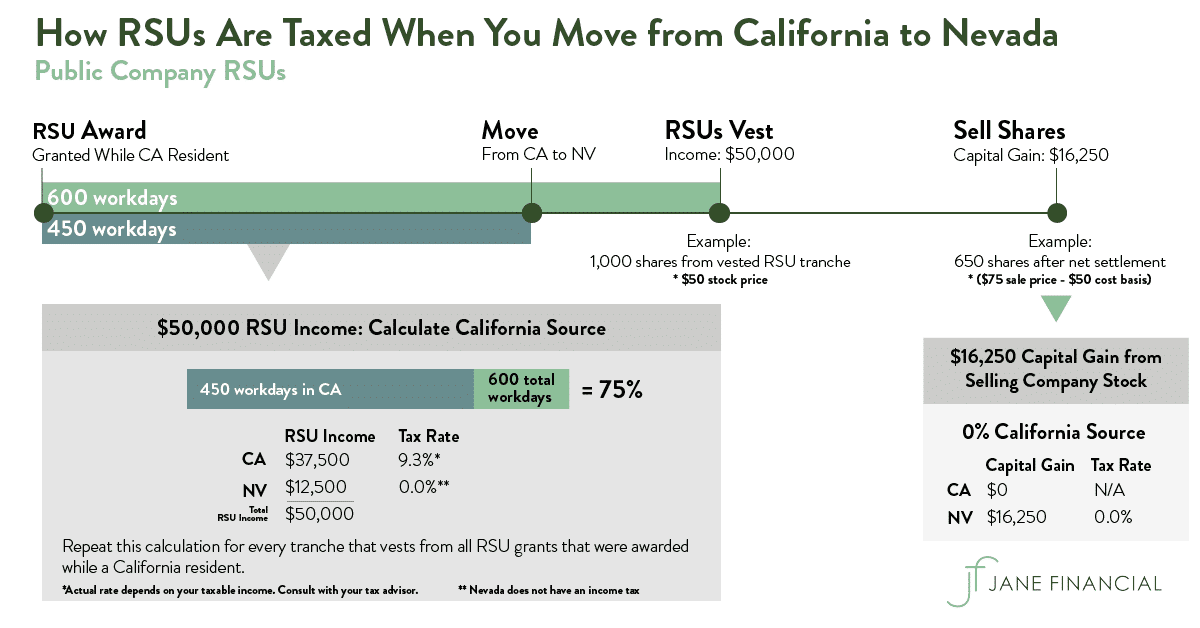

The Hug Formula and the Nelson Formula. Theres a second set of taxes. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income.

Taxes at RSU Vesting When You Take Ownership of Stock Grants. The taxable income incurred on each vest is calculated as follows. If you sell your shares immediately there is no capital gain tax and the only tax you owe is on the income.

There is no single rule or formula. Upon vesting the shares are considered income for the employee. The value of over 1 million will be taxed at 37.

How are rsus taxed in california Wednesday March 9 2022 Edit The payroll withholding tables are graduated based on income so overtime and bonuses can incur higher federal and state income tax withholding compared to your regular pay. Your taxable income is 1000. This doesnt include state income Social Security or Medicare tax withholding.

Not a resident of California granted equity of 6000 shares vesting monthly over 5 years ie 100 share per month for 5 years - January 2020. For people working in California the total tax withholding on your RSUs are actually around 40. RSUs and Taxes.

Theyre taxed as ordinary income - so its based on your marginal tax bracket. A third option is to use one of the formulas for dividing stock options and RSUs in California which are described in more detail below. At vesting date California taxes the portion of the income from RSUs that corresponds to the amount of time you lived in.

RSUs generate taxes at a couple of different milestones. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Moves to California 100 shares vest this month.

In some states such as California the total tax withholding on your RSU is around 40. At the time that these RSUs are received by the taxpayer part of them are actually sold to offset the tax withholdings and some tax withholdings are paid using the proceeds. Because there is no actual stock issued at grant no Section 83 b election is permitted.

California will tax the income to the extent you performed services in this state. Lets start with how taxes on Restricted Stock Units typically work. 100 shares vest at 10share.

Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. Upon sale of the resulting shares. RSUs are taxed as income to you when they vest.

Nov 18 2020 0 5. Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward. Because tax laws differ across states it all depends.

A percentage of the shares are withheld by the company for income taxes. Its important to understand the amount withheld on future RSUs to avoid hefty tax charges afterward or even penalties. Once when you take ownership of the shares usually when they vest and again in another way when you actually sell the shares.

Again the income from RSU is taxable in the state of California to the extent that you worked there from the grant date to the vest date BUT the taxes arent owned until the shares are released so you could be paying taxes to California for years after you leave. This compensation income is subject to federal taxes state taxes and payroll taxes Social Security Medicare. I have a question on how RSUs vest for non-residents who become temporary residents of California.

In Appeal of Prince the OTA approved the FTBs long-standing position that nonresident income from RSUs should be allocated to California based on the employees. For people working in California the total tax withholding on your RSUs are actually around 40. RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest.

In other words if the stock increase in value after youve paid ordinary income tax. Im not a tax guy but my bet is that the RSUs are taxed as income in the state youre in when they vest. The value of the rsus at the time of vesting is taxed as income.

In all states RSUs are taxed as regular income based on value at time of vesting. The 22 doesnt include state income Social Security and Medicare tax withholding. The employee receives the remaining after-tax shares.

Really it would be worth paying a hundred bucks to see a tax guy about this question. You have to pay taxes as soon as the. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

California law is vague when it comes to dividing RSUs in a divorce. Californias Office of Tax Appeals issued a non-precedential decision on the states taxation of restricted stock units RSUs affirming the Franchise Tax Boards grant-to-vest allocation method. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k.

RSUs are generally taxable like salary when shares vest. RSU Wage Income of shares vesting x share price on date of vest This is standard for the IRS but what about from a state perspective. Absolutely but its important to keep in mind.

The short answer to your question is that the RSUs are taxed at vest and upon sale of the resulting shares. With RSUs you are taxed when the shares vest not when theyre granted. Taxation of RSUs.

If your marginal federal income tax bracket is higher than 22 excluding. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. The IRS and California FTB measures your RSU income as each tranche vests.

If you then hold the vested shares for over one year before selling them then any additional gains would be then be taxed at the long-term capital gains rate. There are two main formulas that the courts in California developed to determine how RSUs are divided in divorce the Hug formula and the Nelson formula. In states like California where there is a state tax on earned income part of the shares is sold for federal withholdings and part is sold as state withholdings.

How State Residency Affects Deferred Compensation

Restricted Stock Units Jane Financial

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Restricted Stock Units Jane Financial

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management